The Oregon Shakespeare Festival, 88 years old, is the primary cultural attraction in Southern Oregon. It’s also one of the largest professional regional repertory theater companies in the country, which is why a recent announcement about an emergency fundraising campaign seemed sudden to many in the community.

In April, OSF announced it needed to quickly raise $2.5 million, or else shut down the 2023 season, which was set to begin only a week later. In June, they said they had met that goal, but now needed to raise another $7.3 million to complete the season.

According to , there are a variety of reasons why the theater company ended up in such a tight spot.

Lack of liquid assets

The first has to do with how OSF holds its assets. According to its , their total assets were nearly $96 million. But the majority was held in ways that weren’t easily usable.

“If you look at their total assets, or total net worth, [it] actually looks quite high,” said Renee Irvin, Director of the School of Planning, Public Policy and Management at the University of Oregon, who specializes in nonprofit finance. She reviewed OSF's 990 tax forms.

“You have to take into account that a lot of that is in the form of their land and buildings. So that's, you know, their buildings are worth quite a bit. You can't just simply get rid of your stages. So it's very non-liquid,” she said.

While Irvin said this breakdown is normal for big arts nonprofits, it also means OSF couldn’t easily access that money.

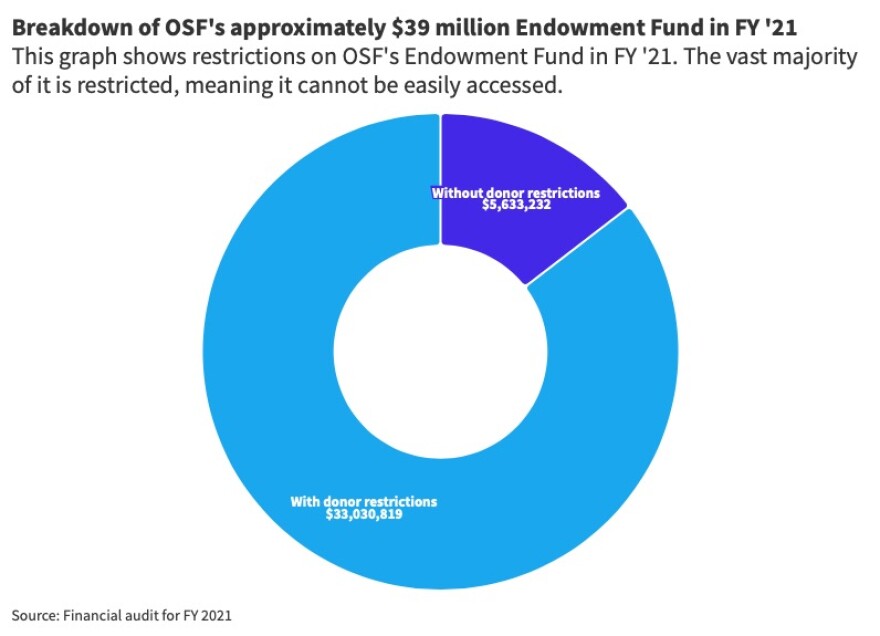

In addition, almost all the money held in its approximately $39 million Endowment Fund was restricted by donors to be used for specific purposes, according to OSF’s financial audit from FY21. Only about 15% of the theater’s endowment fund was unrestricted.

OSF was left with about $25 million in cash and other assets, which includes investments, inventory and prepaid expenses. While that might seem like a lot of money, the company's total operating expenses for FY21 were over $18 million.

So although OSF’s assets totaled about $96 million, it was mostly restricted or held in the form of things like buildings, meaning it couldn’t actually be used to address financial problems.

“OSF does have many assets and many advantages and wonderful stages and facilities. But there are times, like our post-COVID world, where the cash has been a little more difficult to lay our hands on,” said OSF Board Chair Diane Yu.

Dependence on plummeting ticket sales

Of course, the most obvious answer for these money troubles is COVID. It’s no secret that performing arts organizations around the country were hit hard by the pandemic. In March 2020, as worries about the pandemic were becoming clear in Southern Oregon, OSF laid off about 80% of its workforce.

Yu said the company was affected both by COVID and by choking wildfire smoke, which forced them to cancel some shows in their outdoor Elizabethan theater.

“We've been basically in a recovery mode since the 2020-21 pandemic. And I think that's the real reason why things have been stressed more. We've had some management and infrastructure issues that didn't adapt well to those two major business disruptions,” she said.

Some in Ashland also say OSF's decline in ticket sales is the result of alienating its core audience of primarily white, middle-aged tourists through shows that are too focused on social justice and racial issues rather than on traditional Shakespeare.

Yu said historically, OSF has gotten 70-80% of its operating revenue solely from ticket sales for plays.

Liam Kaas-Lentz, managing director at Portland Center Stage, said theater companies usually earn about 50-60% of their revenue from ticket sales. He said Portland Center Stage’s ticket sales are currently down about 30%.

Meanwhile, OSF’s revenue from ticket sales plummeted during peak COVID years by almost 98%, according to an analysis for JPR by Kevin Marold, a forensic accountant in Portland who reviewed OSF’s audited financial statements between 2013 and 2021, the most recent year they were available. He excluded 2019 from his analysis because a lack of detail in those tax documents made it difficult to compare to other years.

As the vast majority of OSF’s revenue from ticket sales went away during COVID and the majority of their other assets were held in infrastructure like buildings, they had few options to pay the bills.

To adjust, OSF has also done fewer shows and shortened its season in recent years. That was meant to be a way to save money, but Yu said it also meant there were fewer tickets to sell and fewer ways to make money.

“Those things which are consistent with trying to conserve on the expense side do have an effect on the revenue side. So that's to make it an exquisite challenge,” she said.

Yu said ticket sales currently make up between 25-35% of the theater’s revenue.

In addition, Marold said OSF’s memberships have declined recently.

“During 2020 and 2021, memberships contributed approximately $1.8 million on average or a decrease of nearly 60% of the historical norms,” he said, based on his analysis of OSF’s audited financial documents.

According to OSF’s new interim executive director, Tyler Hokama, its 2022 audited financial statements are not yet complete.

Reliance on one-time gifts and grants

Without those ticket sales or memberships, OSF has become increasingly reliant on one-time gifts and grants, Marold said.

Irvin said the type of grassroots emergency fundraising campaign that OSF did earlier this year can really only be a one-time strategy.

“The unusual thing to me is the very public nature of the ask. It is unusual to, and very difficult actually, to raise money for a budget deficit. That just doesn't excite donors in general. So you can do it maybe once and say, ‘Hey, we're in a tough spot,’” Irvin said. “But, you know, putting your hands out and asking for an extraordinary gift like this with a grassroots appeal is sort of a one-time strategy, and you can't do this year after year.”

“Our model was fine when we didn't have all these crises,” Yu said. “But the crises that we've experienced have had an impact. And that's what we're adjusting to now.”

The Shakespeare company received over $5 million in Paycheck Protection Program loan money during the pandemic, nearly all of which was forgiven. In November, it received a $10 million grant from The Hitz Foundation, and in December, the OSF board released $4.5 million from its Endowment Fund to help support operating expenses. Yu said that money has all been spent.

“Without those one-time forms of other support, the organization would have already been done for,” Marold said.

OSF’s long-term viability

Irvin praised OSF for cutting costs in recent years and said its administrative salaries were quite modest.

“We are moving in the right direction, I believe, and if we continue to keep moving forward together, we will keep, you know, having shows and having live theater at OSF,” said Interim Development Director Kamilah Long.

Marold, meanwhile, said based on his analysis of OSF’s tax history, he’s unsure about its long-term viability, with a lack of cash flow, the difficulty of relying on one-time gifts and dwindling ticket sales.

“My goodness, I would say they are in danger,” he said. “What I see is a company that has lost its most significant revenue stream and is generating some pretty significant losses.”

He said OSF’s financial statements did not reveal any red flags or suspicious activity.

According to an interview with Long in April, the company’s financial trouble “predates the leadership. And so it's not even a leadership problem. It's just a cumulative problem, I believe, that has been not addressed for a while.”

Of course, OSF is not the only theater struggling and depending on grants and other funding.

“It is not hyperbolic to say that the field itself is on a precipice,” said Kaas-Lentz. “It's going to take a lot of government agencies and foundations to step up and keep the industry from closing down.”

Former Executive Director David Schmitz, who left OSF in January, did not respond to requests for comment.

Yu said planning for next year’s season has “a slight pause on it,” and OSF will need to do more fundraising for that. The company will announce additional specific fundraising goals for the 2024 season later this summer, after the nonprofit’s annual budget has been completed.

Still, Yu is optimistic about the future. OSF hopes the recently-hired Hokama will put the company on the right path.

“We know what some of the both infrastructure and these cash flow issues are,” Yu said, “and acknowledging the issues and knowing what they are is the first step towards resolving them.”